Serviços Personalizados

Journal

Artigo

Compartilhar

Educação em Revista

versão impressa ISSN 0102-4698versão On-line ISSN 1982-6621

Educ. rev. vol.35 Belo Horizonte jan./dez 2019 Epub 12-Mar-2019

https://doi.org/10.1590/0102-4698194676

Article

REDISTRIBUTIVE MECHANISMS IN THE BRAZILIAN UNION’S FINANCIAL ASSISTANCE FOR BASIC EDUCATION

IFederal University of Maranhão, São Luís, MA, Brasil.

IIFederal University of Minas Gerais, Postgraduation Program in Education, Belo Horizonte, MG, Brasil.

This article analyzes the influence of technical, redistributive and political-party factors in the Brazilian Union’s financial assistance to basic education, considering the federal government’s induction mechanisms in programs for legal and voluntary assistance. The analysis was performed based on data about Union’s transfers for the municipalities, found in the Transparency Website, during the period of 2004 to 2014. Using multiple regression analysis, empirical evidences are presented, showing that the federal government’s induction mechanisms influence the transfers for municipalities with low educational indicators and income. However, these mechanisms are restricted to a small group of action, being unable to promote equity among federated entities regarding financial resources.

Keywords: Federalism; Education Funding; Union Assistance; Equity

O artigo analisa a influência de condicionantes técnicos, redistributivos e político-partidários na assistência financeira da União no âmbito da educação básica, levando em consideração os mecanismos de indução do governo federal nos programas de assistência legal e voluntária. A análise é realizada a partir de dados de transferências da União para os municípios oriundos do Portal da Transparência, no período de 2004 a 2014. Utilizando-se análise de regressão múltipla, apresentam-se evidências empíricas de que os mecanismos de indução do governo federal influenciam as transferências para municípios com baixos indicadores educacionais e com menor receita própria, porém, ficam limitados a um pequeno grupo de ações, não sendo capazes de promover a equidade entre os entes federados na dimensão dos recursos financeiros.

Palavras-chave: Federalismo; Financiamento da Educação; Assistência da União; Equidade

INTRODUCTION

One of the fundamental characteristics of federal systems is the institution of mechanisms to ease intergovernmental collaboration, specially in federations where the vertical fiscal gap - the difference between resource collection and the need for offering public services - is great. In all federations, as Watts (2008) has shown, intergovernmental transfers have been the main mechanism used to achieve fiscal equity, despite having different arrangements, considering the characteristics of its asymmetries.

In Brazil, which has many asymmetries, both vertical and horizontal ones, intergovernmental transfers have been constituted as an important mechanism to ensure receipt for most of Brazilian municipalities. In the scope of public policies for education, the arrangements for intergovernmental transfers combine constitutional, legal, and voluntary transfers. The Union’s legal and voluntary transfers comprise its technical and financial assistance that, according to the Constitutional Amendment no. 14/1996, is the way for the Union to practice its subsidiary and redistributive function in relation to the other federal entities, aiming at guaranteeing the equalization of educational opportunities and a minimum quality standard. Legal transfers compose the complementation to the Fundo de Manutenção e Desenvolvimento do Ensino Fundamental e de Valorização do Magistério (FUNDEF - Fund for the Maintenance e Development of Primary School and for Valuing the Magisterium)/Fundo de Manutenção e Desenvolvimento da Educação Básica e de Valorização dos Profissionais de Educação (FUNDEB - Fund for the Maintenance and Development of Basic Education and For Valuing Education Professionals) and the Legal Assistance Programs, such as: Programa Nacional de Alimentação Escolar (PNAE - National Program of School Alimentation), Programa Nacional de Transporte Escolar (PNATE - National Program of School Transportation), Programa Dinheiro Direto na Escola (PDDE - Money Straight to School Program), Programa Especial de Fortalecimento do Ensino Médio (Special Program for Strengthening High School), and Programa de Apoio aos Sistemas de Ensino para Atendimento à Educação de Jovens e Adultos (Supporting Program for Teaching Systems for Adult Education). Voluntary transfers involve both transfers organized by programs (most of them) and those performed though specific partnerships.

This article focuses on the assistance performed solely through technical and financial assistance programs, which involve both Legal Assistance Programs (LAP) and Voluntary Assistance Programs (VAP), with the main objective of analyzing if the new design of the Union’s technical and financial assistance for municipalities, introduced in 2004 and which culminated on the Education Development Plan, in 2007, has resulted on a greater equity in the distribution of resources among federal entities. For that end, we tested the influence of the federal government’s induction mechanisms in face of the technical-administrative conditions of the municipalities and the political-party factors when receiving resources from the Union assistance programs by the municipal governments.

The article begins with the presentation of some theoretical arguments on the relation among intergovernmental transfers, equity, and asymmetries in the Brazilian federalism. After that, based on the Union assistance model that has taken shape after 2004, we aim, through multiple regression analysis, to assess if this model contributed for a better distribution of these program’s resources, considering the achievement of higher equity in the Brazilian federation, regarding the financial resources.

THEORETICAL ARGUMENTS ON THE RELATION BETWEEN INTERGOVERNMENTAL TRANSFERS AND EQUITY IN THE BRAZILIAN FEDERATION

Many researchers in the federalism field, both in the scope of political sciences and public segment economy, such as Musgrave (1959), Obinger, Leibfried and Castles (2005), Arretche (2010, 2012), argue in favor of concentrating the decision authority and of the regulating apparatus in the federal government to guarantee the necessary equity and unit for a federation, According to Arretche (2010, p. 191),

that the Union concentrates regulatory authority in order to create institutional mechanisms that help reduce place-inequality. However, local governments’ authority tends to produce divergences on the implementation of their own public policies. Consequently, federal states that combine centralized authority and the political autonomy of local governments tend to restrict levels of territorial inequality. This result can be explained by two apparently contradictory tendencies: the regulatory role of the central government operates toward uniformity, whereas local governance operates toward divergence.

In the Brazilian case, Arretche (2004, 2010, 2012) states that the federal government has the resources to influence the agenda of subnational governments, since it has wide constitutional prerogatives that guarantee it with the decision authority and the power of regulation social macro-politics. One of these resources is the design the government draws to each public policy, which can incorporate mechanisms to reduce inequity among federation units.

Abrucio (2010) highlights another aspect that may also affect the transfer of resources, as well as its potential to reduce inequality - the great regional differences and the restricted political-administrative capacity of some federated entities of proposing and coordinating policies. In this author’s analysis, the complexity of the relation between intergovernmental transfers and inequality in Brazil happens partly because the autonomy of federated entities is strictly connected not only to the financial dependence level, but also to the ways of local power relations, the degree of democratization in public administration and to the political-administrative capacity that the entities develop. In Brazil, historically, these aspects have presented asymmetrical relations, so that:

achieving the position of federation entity, in fact, has been little absorbed by most municipalities, once they present a strong dependence in relation to other government levels. There is a federative paradox in the situation: when these cities receive help and do not develop political-administrative capacities, they may lose some autonomy; but, in case they do not receive or want support, they may become unable of performing public policies thoroughly (ABRUCIO, 2010, p. 45).

Thus, the exercise of autonomy for most municipalities is, still nowadays, extremely conditioned to the position they take on in the scenario of social, economic and political inequalities within the federation.

Rezende (2007, 2010, 2012) and Santos (2009) have highlighted that intergovernmental transfers, specially conditioned and voluntary ones, will always present limitations to equalize, nation-wide, the standards for public policy access, since they are not capable of changing the dynamics of the investments within less-developed regions, that is, the transfers affect the creation of local demand for goods, but not necessarily the production of the goods to be offered, given that its power for internalizing productive capacity is low and, generally, in these cases, causes more dependence than autonomy.

In this sense, Mendes (2013) also highlights that transfers tend to be affected by the investment structure and by the administrative capacity already historically stablished in the more developed regions, perpetuating intra- and inter-regional inequalities, that is, the states and municipalities with bigger administrative and fiscal structures tend to receive more resources from governmental transfers, be them constitutional, legal or voluntary ones.

In the specific field of education, there are few studies that deal with the redistributive effects of intergovernmental transfers. We highlight t two studies in the last decade that follow this path - Cruz (2009) and Araújo (2013). The first focuses on the actions by the Fundo Nacional de Desenvolvimento da Educação (FNDE - National Fund for Education Development), while the second focuses on the FUNDEB.

Araújo (2013), based on the arguments by Arretche (2012), presents evidence indicating that the reduction of resource inequalities among federation units for the offer and maintenance of education depends widely on more resource input from the Union and on distribution mechanisms focused on territorial inequalities, given the receipt restrictions of most federation units.

Cruz (2009), when studying the subsidiary and redistributive action of the Union by the FNDE programs, shows that, despite existing a coherence in the criteria stablished with the concern of driving the financial assistance resources by the Ministry of Education (MEC) primarily to places with the lowest education offer and quality indicators, the performed transfers are not coherent to these criteria, that is, these transfers were not being made with the intention of promoting higher equity among the federation units.

Given that, the literature on Brazilian federalism provides elements that point out to different factors that may influence the transfer of resources for technical and financial assistance by the Union for the subnational federal entities, and specifically the resources of voluntary transfers, such as: the design of technical and financial assistance policies, the political-administrative capacity of governments, the entities’ fiscal capacity, and the political-party relations between the federal government and subnational governments.

Regarding this last aspect, some studies on the political-party factors on voluntary Union transfers diverge concerning evidences that belonging to the federal government’s party coalition affects receiving these resources; While Duchateau and Aguirre (2007), Ferreira and Bugarin (2007), and Soares (2012) have found positive correlations between receiving voluntary Union transfers and mayors and governors who belonged to the president’s party coalition, Arretche and Rodden (2004) affirm that there are no evidences showing that the President favors governors with transfer of resources.

This work is an effort in the direction of studies on intergovernmental transfers in the specific field of education, which intends to widen the approaches used in the scope of the relations between federalism and education funding, specially regarding those that deal with the redistributive dimension of resources, considering the promotion of higher equality across the Brazilian federation, as in the example of the studies by Cruz (2009) and Araújo (2013).

INFLUENCE OF POLITICAL, TECHNICAL AND REDISTRIBUTIVE FACTORS ON TRANSFERS BY THE UNION’S TECHNICAL AND FINANCIAL ASSISTANCE PROGRAMS

The Union’s policy of technical and financial assistance for basic education had incorporated, after 2004, a set of arrangements that increased the Union’s influence on the educational agenda of subnational governments, specially of municipal governments, with the adoption of redistributive mechanisms in different criteria aiming at covering the diverse educational conditions of federated units, which were linked, since 2007, to the Índice de Desenvolvimento da Educação Básica (IDEB - Basic Education Development Index) and to the Plano de Ações Articuladas (PAR - Plan of Articulated Actions).

These new arrangements have resulted on an increase of transfers per capita by the Union’s technical and financial assistance programs. The value/student1 transferred to subnational governments, through the technical and financial assistance (legal and voluntary) programs has grown from R$ 94.61, in 2004, to R$ 207,31, in 2014, having its highest value in 2010 (R$ 262,58).

The analysis of transfers by the Union’s assistance programs from 2004 to 2014, considering the governmental sphere and the regions, performed by Cavalcanti (2016) has shown that, despite the prioritization of municipal governments in the Northeast and Northern regions in the Union’s voluntary assistance, after 2007, with the PDE policy, the State governments in these regions have received a value/student higher than municipal governments, both in Legal Assistance Programs (LAP) and Voluntary Assistance Programs (VAP). This situation was not observed in the other regions. Thus, one can infer a correlation between territorial inequality and the federated municipal entity.

Given these results, we aim, through a multiple regression analysis, to assess the influence of induction mechanisms by the federal government in relation to other factors that may also affect the transfer of resources by the Union’s assistance programs directed to basic education for subnational units, as the governments’ fiscal and administrative capacity. For this analysis, only the transfers to municipalities from 2004 to 2014 will be considered, since these are the main target of the Union’s voluntary assistance and given the relation observed between resource inequality and the municipal governments. Therefore, the analysis level is the annual transfers received by municipalities, comprising a total of 52,708 annual transfers distributed among 5,295 municipalities, 95% of the total number of Brazilian municipalities.

To construct the database, we used the software Stata (Statistics Data Analysis), in which it is possible to build databases with the desired programming level, besides having a fairly simple language and many pre-programed commands that make data handling easier. The municipality’s database was characterized by a panel format with fixed effect, in which each entity is represented by a series of data throughout 11 years (2004 to 2014). The choice of method did not aim to capture the longitudinal effects of the variables, but to control the non-observed effects in time that could be correlated to the explanatory variables in the statistical model.

To determine only the resources from transfers by the Union’s legal and voluntary assistance programs for basic education, the data were filtered considering the function, subfunction, and codes of the programs and actions. The Function 12 (Education) was considered, excluding: (a) the subfunctions 364 (Higher Education), 363 (Professional Education), 302 (Hospital and outpatient assistance), 212 (International Cooperation), 122 (General administration), 571 (Scientific Development), 572 (Technological and Engineering Development), 573 (Distribution of Scientific and Technological Knowledge), 301 (Basic Care); (b) the subfunction 128 (Formation of Human Resources) when associated to the code of the action 6315 (Teaching Qualification in Post-Graduate Level); (c) the subfunction 126 (Information Technology) when associated to the action 4172 (Communication Services of the National Network of Teaching and Research); (d) the programs 1062 (Development of Professional and Technologic Education) and 1073 (21st century University). These subfunctions, actions or program were excluded because they regard transfers of resources for higher education or for bodies of the federal government, thus, they are not destined to basic education nor to the city’s teaching network (focus of our analysis). Considering this analysis also focuses only on programs of technical and financial assistance of the federal government to the municipal administration, which composes the model of politics in debate were excluded the actions 304 (Complementation to FUNDEF) and 0C33 (Complementation to FUNDEB), 09DK (PAED), 2991 (Hugh School Functioning in the Federal Network). The Function 14 (Citizenship Rights) was also considered, including only the Subfunction 366 (Adult and Young Education), which comprises resources directed to the National Program for Young Inclusion (PROJOVEM). It is also noteworthy that the exclusion of action 09DK (PAED) is due to the fact that this program is destined exclusively to non-profit entities that offer special education.

The dependent variable - annual transfer per student by the Union’s technical and financial assistance programs to municipalities for the offer and maintenance of basic education - was tested in four different models, using the following regression equation:

In which:

β 0, β 1,..., β p-1, are the parameters given by the line’s inclination, that is, the expected variation in Y when X increases by an unit;

X i1 ,..., X i,p-1 are the values for the known independent variables, that is the transfers per capita;

?i (Error) are independent with distribution N(0, ?2)

i=1,2,...,n.

The Model 1 considers the transfers by the technical and financial assistance programs in their totality, regardless of the type of programs. In the other models, the transfers were organized according to the programs’ characteristics regarding the entry ways for the subnational federated entities. . The programs selected to compose each model, inside the adopted typology were the ones that moved a higher amount of resources in the period, also encompassing a higher number of cities.

Thus, Model 2 comprises the transfers of Type 1 programs (PNAE and PDDE), legal assistance programs that have values per capta for all municipalities under the same criteria.

In the Model 3 are the transfers by Type 2 programs, which comprise programs with different criteria for selection the recipients, stablished by the MEC/FNDE focusing on the educational situation of municipalities. Such programs would express an uneven treatment, through the induction by the federal government, in order to reduce inequalities. For this group, we selected the PROJOVEM, the National Program of Restructuring and Equipment Acquisition for the Public School Network of Early Childhood Education (Proinfância ) and the School Path.

In the Model 4 are the Type 3 programs, which are open to all municipalities, depending on the presentation of projects or plans. These programs would better express the entity’s capacity in presenting projects, as well as in fulfilling other requisites by the MEC/FNDE in order to receive the resources. In this group are the Literate Brazil Program and the Program of Restructuring the Public Physical Network in Basic Education.

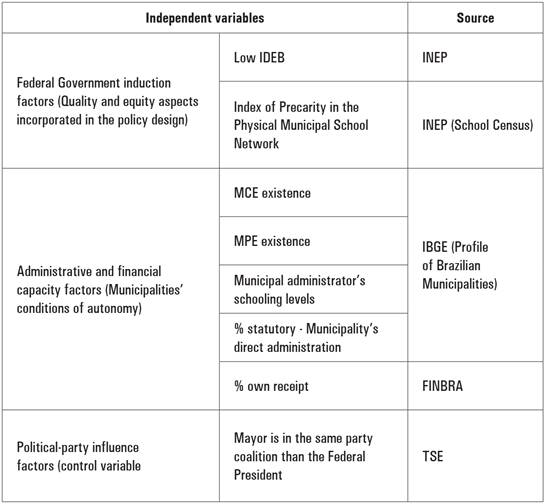

The results of the analysis of variance (ANOVA)2 have indicated that, in the models 1 and 3, only the variable “Existence of an Education Plan” did not interact with the dependent variable. While in the model 4, the variables “IPRFEM” (Index of Precarity in the Physical Municipal School Network) and “Administrator’s schooling levels” did not present this effect. Lastly, in the Model 2, all variables have affected the dependent one, indicating that this is the best adjusted model. Even though the test indicated the non-interaction of some variables, in some models, we chose to keep them, since the aim is to compare a same explanatory model for different variables, as well as one variable in the different models. Independent variables were organized into three groups, according to Chart 1.

The IDEB, although considering the many critiques on its limitations as assessing the quality of public education, is the general indicator used by the MEC/FNDE to guide its technical and financial assistance policy since 2007 and, due to that, it was incorporated as a variable (a general one) to assess the effects of the government’s induction mechanisms for transfers. Also considering the large missing amount in the initial years of elementary education, we have chosen to work only with the IDEB of its final years,3 so to increase reliability.

The IPRFEM was specifically constructed for this research, considering the large amount of assistance programs oriented towards improving the physical structure of schools. Therefore, the physical condition of the school network (inadequate) was a factor considered in the federal government induction. The IPRFEM was calculated based on the following data from the School Census: Inadequate place for the school to work (shed, teacher’s house, church, barn), inexistent or inadequate water supply (pool, well, river, stream); inexistent sanitary sewage; inadequate garbage disposal; lack of basic dependences (library, laboratories, sports court, accessible toilets); lack of essential pedagogical equipment (copying machine, VCR, TV, Datashow, computer, printer, internet connection). For each component group different weights were given, considering the different impact level of the component in the precarious condition of the school.4 Thus, it was attributed a 35/100 weight for the type of space where the school operates; for basic infrastructure components (water supply, sewage and garbage), a 25/100 weight; for the basic dependence component, the weight was of 25/100; and, for the pedagogical equipment, it was of 15/100. Therefore, the indicator ranges from 0 to 1, with the maximum score representing the worst condition. The numbers were calculated for each school in the municipal network, based on the sum of scores obtained for the variables. To obtain the result of the indicator in the school network level, the simple average of values obtained by all municipal schools was calculated.

The second group gathers a set of variables, aiming to test the effects of the municipalities’ conditions of practicing their autonomy in implementing policies about receiving resources: existence of a Municipal Council of Education (MCE); existence of a Municipal Plan for Education (MPE); Municipal Administrator having higher education, being graduated and post-graduated; percentage of statutory in the municipality’s direct administration; percentage of own receipt. Apart from the last variable, which was designed based on the data from the database Finanças do Brasil/Secretaria do Tesouro Nacional (FINBRA/STN - Brazilian Finances/National Treasure Secretariat), all other ones come from the research of the Instituto Brasileiro de Geografia e Estatística (IBGE - Brazilian Institute of Geography and Statistics) “Brazilian Municipalities Profile”. It is important to highlight that such variables are proxies to assess the effects of the administrative and financial capacity of the municipal entities when receiving the resources from technical and financial assistance programs, that is, those were the closest indicators found to represent the administrative and financial capacity of municipal entities, although we recognize the limitations of these variables as the expression of the municipalities administrative capacity, the supposition is that they express the municipality with a more organized teaching system, which is also more prone to filling the MEC/FNDE requirements, as well as to present their own projects.

The third group is composed by the variable indicating if the mayor belongs to the same party coalition than the Federation President, which aims to test the effect of political-party factors on the transfer of resources and also works as a control variable in relation to the others.5 This is a dummy variable, coded into yes (1) or no (0).

The multivariate regression analysis uses the same theoretical-explanatory model and the same dependent variable (transfers by the Union’s technical and financial assistance programs to subnational elements for the offer and maintenance of basic education), however, four regression models were built with different ways of composing the dependent variable, as explained before. Table 1 presents the results of the multiple regression for these four models.

TABLE 1 Influence factors for transfers by the Union’s technical and financial assistance programs for Municipalities. Brazil, 2004 - 2014 (Value/student)

| VARIABLES | Model 1 | Model 2 | Model 3 | Model 4 |

|---|---|---|---|---|

| Total | Prog. Type 1 | Prog. Type 2 | Prog. Type 3 | |

| IDEB-Initial Years | 0.398*** | 0.258*** | 0.219*** | 0.649*** |

| (0.612) | (0.582) | (0.192) | (0.369) | |

| IPRFEM | 0.310*** | 0.00114 | 0.120 | -0.112 |

| (0.0592) | (0.000318) | (0.0135) | (-0.00805) | |

| MPE Existence | 0.0868*** | 0.0367*** | 0.0469 | 0.0310 |

| (0.0589) | (0.0365) | (0.0192) | (0.00850) | |

| MCE Existence | 0.243*** | 0.157*** | 0.278*** | 0.382*** |

| (0.139) | (0.132) | (0.0824) | (0.0826) | |

| Statutory percentage | 0.00121*** | 0.000998*** | -0.00385** | 0.00278** |

| (0.0429) | (0.0520) | (-0.0761) | (0.0367) | |

| Education Director Schooling level - Graduated | 0.151*** | 0.0726*** | -0.0310 | 0.0435 |

| (0.0984) | (0.0695) | (-0.0118) | (0.0113) | |

| Education Director Schooling level - Post-graduated | 0.212*** | 0.136*** | -0.114 | 0.134* |

| (0.143) | (0.135) | (-0.0452) | (0.0361) | |

| Percentage of Own Receipt | -0.00173 | 0.000761 | -0.000100 | 0.00938 |

| (-0.0135) | (0.00872) | (-0.000554) | (0.0305) | |

| Mayor belonging to the coalition of the Federation President | 0.0522*** | 0.0462*** | 0.0352 | 0.0539 |

| (0.0355) | (0.0461) | (0.0144) | (0.0147) | |

| Constant | 2.829*** | 3.177*** | 3.638*** | 0.0434 |

| Observation | 52,708 | 52,675 | 6,575 | 13,529 |

| Number of Municipalities | 5,295 | 5,295 | 3,782 | 4,168 |

| R² within | 0.2155 | 0.2034 | 0.0171 | 0.0749 |

*** p<0.01, ** p<0.05, * p<0.1, Observation: Normalized Beta Coefficients in brackets. Source: Authors’ database (data origin: Transparency Portal, School Census, FINBRA, IBGE, TSE).

The Model 1 involves the transfers of all technical and financial assistance programs for a total number of 5,295 municipalities that are present in the research’s database, involving 52,708 observations. In this model, both variables that aim to assess the federal government’s induction mechanisms - a general one (IDEB) and a specific one (IPRFEM) - in the transfer of resources have presented positive impacts in opposite directions.6 The higher the municipality’s IDEB, more transfers it receives. Keeping all other variables constant, the increase of 1.0 in the IDEB implies on a 40% increase in the transfer of resources by technical and financial assistance programs. This result indicates that the prioritization of municipalities with lower IDEBs to receive voluntary assistance for the Union has not had a proportion enough to affect the transfer of resources by the Union’s technical and financial assistance as a whole. Regarding the IPRFEM, the result shows that the more precarious the physical school network in the municipality is, more it receives resources by the technical and financial assistance programs as a whole. When considered the 0 to 10 scale in this indicator, the increase of a unit in this scale corresponds to a 31% increase in the amount of resources received, when all other factors are kept constant. This result may be explained both by the great amount of resources operationalized by voluntary assistance programs oriented towards municipalities with precarious physical school networks, and by the impact of this indicator in the municipal school network, since 35.7% of Brazilian municipalities have a IPRFEM equal to or higher than 5.0.

n relation to the variables that aim to assess the influence of the municipality’s technical-administrative capacity and, consequently, how their condition of practicing their autonomy affect the transfer of resources, all variables presented positive coefficient. Municipalities that have MCE received 24.3% more resources than the ones that do not have it, when all other variables were kept constant. Municipalities with education directors who are graduated received 15.1% more resources than the ones in which the municipal education director has lower schooling levels, and when the administrator is post-graduated, the difference is even bigger, reaching 21.2%.7 The existence of a Municipal Plan of Education and the statutory percentage in the municipality’s employee board have presented lower impacts. The municipalities that have MPEs receive 8.7% more resources than the other ones; and, for each 1% increase of statutory employees in the municipality, there is only a 0.1% increase in the transfer of resources by the Union’s financial and technical assistance programs, when the other variables are kept constant. These variables, together, indicate that municipalities with higher technical-administrative capacities have higher chances of receiving resources by the Union’s programs as a whole.

The variable of the municipality’s fiscal capacity was the only one that did not show statistical significance, indicating, thus, that in the set of data of the Model 1 (the one with the highest number of observations), this is not an explanatory variable for the federal government transfers.

The political-party influence variable has present little impact on the transfer of resources by the programs as a whole, for when the municipal mayor belongs to the same party coalition than the Federation President, the increase in the transfer of resources was only of 5.2% in relation to other municipalities, when all other variables were kept stable.

In short, when dealing with the transfer of resources by the set of Union’s technical and financial assistance programs, there is the influence of both the federal government induction mechanisms and the municipality’s educational conditions and technical-administrative capacity, understood here specially as the components of a more organized municipal education system, given most of this group’s variables. On the other hand, the results also express the influence of school network characteristics of each municipality, considering that, in the set of programs, legal transfers represent the highest amount of resources, as explained in the last section.

It is necessary, now, to assess how the variables behave when these programs’ transfers are separated according to its characteristics, that is, according to each of the determined groups.

As explained before, the Model 2 comprises the transfers of two legal assistance programs (PNAE and PDDE), which have values per capita for all municipalities under the same criteria and would express, thus, an equal treatment for all entities. In this case, the differences stablished would result from the characteristics of each teaching network and not from different criteria in the programs. The number of municipalities involved in this group was of 5,295, with a total sum of 52,492 observations.

Regarding the variables that aim to assess the federal government induction mechanisms in the transfer of resources, only the IDEB presented a significant impact. Municipalities with higher IDEB receive more transfers from the programs composing this model, however, in a lower range then in the first model. The increase of 1.0 in the IDEB causes a 25.8% increase in the transfer of resources by the programs in the Group 1, when all other variables are kept constant. The IPRFEM did not present statistical significance in the Model 2, and, considering the great number of observations (52.675), it is possible to affirm that this variable does not explain the transfers by said programs, which is coherent to the results of the documental research, since no legal transfer program has this situation as a criterion for a different value.

In relation to the variables of influence of the municipality’s technical-administrative capacity, all variables presented positive impacts on the transfer of resources, however, its effect is lower when compared to the Model 1. The existence of MCE in the municipality has increased the transfer of resources in 15.7% in relation to the other ones, which is lower, thus, than in the Model 1. The existence of MPE in this group of programs has increased the transfer of resources only in 3.7%. Regarding the administrator’s schooling levels, its influence on receiving resources was way lower then in the first model - only 7.26% more than municipalities with administrators with lower schooling levels; and in the case of post-graduated administrators, the difference grows to 13.6%. The effect of the percentage of statutory employees in the municipality board was still very low (as in Model 1) - for each 1% increase in the number of statutory employees in the municipality, there is a growth of only 0.1% in the transfer of resources by programs in the group 1. The variable own receipt had virtually no effects on receiving resources in this model. For each 1% increase in the municipality’s own receipt, there is a growth of only 0.07%.

The political-party variable, belonging to the same party coalition than the Federation President, also did not show statistical significance and, thus, is not constituted as an explanatory variable for transfers in this model.

In short, the result for Model 2 is fairly obvious: the transfers by universal programs with equal criteria for all municipalities are little influenced by the federal government’s induction mechanisms and by the technical-administrative capacity of municipalities. Therefore, it is possible to infer that what predominates in this model is the previous educational condition, that is, the characteristics of each municipality’s school network. Given that, it is possible to affirm that equal criteria do not favor a higher transfer of resources for municipalities in unfavorable educational situations or that have little technical-administrative capacity, although it is not actually proper to affirm the opposite, since the influence of educational conditions and technical-administrative capacities was way lower than in the first model.

Model 3 comprises the transfers by programs with different criteria for the selection of beneficiaries (Projovem, Proinfância and Caminho da Escola), stablished by MEC/FNDE, focusing on the municipalities’ educational conditions, which would express an unequal treatment, through the government’s induction, in order to correct inequalities. Considering this group’s characteristics, the number of municipalities was reduced in relation to previous models (n=3,782), with 6,575 observations, which can explain the great number of variables with no statistical significance. In this model, only three variables have shown statistical significance and sufficient magnitude (IDEB, MCE, statutory percentage) to explain the dependent variable.

The results show that municipalities with better IDEB rates continued to receive more resources, even in programs that even its design and priority beneficiaries defined by the MEC. However, when compared to the other models, in this one the IDEB influence on the transfer of resources was lower. When all other variables were kept stable, an increase of 1.0 in the IDEB implies on a 22% increase in the transfer of resources from programs integrating this model. The impact of IDEB on the transfer of resources by programs in this model drops 3.8% in relation to the previous one, 17.8% in relation to the first one, and 43% in relation to Model 4. This means that municipalities with higher IDEB kept on receiving more resources from programs induced by the MEC, but in a lower scale than in the other sets of programs.

In the set of variables designed to assess the influence of the municipalities’ technical-administrative capacity in receiving resources from the analyzed programs, only the existence of MCE was statistically significant to explain the dependent variable. The existence of a MCE in the municipality has implied on a 27.8% increase in relation to other municipalities that do not have one, when other variables were constant. The variable that analyzes the influence of the municipal fiscal capacity, as well as the political-party variable, did not present statistical significance and, also considering its low magnitude (very close to zero), it is not an explanatory variable for transfers in this model.

The results of Model 3 do not allow us to affirm that poorer municipalities (with lower percentages of own receipt), with more precarious physical school networks, and lower IDEB have received more resources from programs induced by MEC, therefore, they do not confirm the hypothesis that guided the statistical model, but are coherent to the descriptive statistics that show that municipalities in the Northeast and Northern regions, the most prioritized ones in these policies, kept on receiving more resources from voluntary transfers.

Model 4 gathers the transfers by programs open to all municipalities, with the receipt of resources depending on the municipality presenting projects or plans, thus, depending more on the municipal government’s initiative. In this group of programs, 4,168 municipalities were benefited, with 13,529 observations.

In this model, the variables that test the influence of induction mechanisms have presented results similar to the research’s suppositions. In this model, the IDEB had more impact on the transfer of resources. The increase of 1.0 in the IDEB was equal to a 65% increase in the transfer of resources, when all other factors were constant.

Regarding the set of variables measuring the municipalities’ technical-administrative capacity, only the variables “MCE existence”, “statutory percentage”, and “post-graduated director” have presented statistical significance to explain the transfer of resources by the programs included in Model 4. The existence of a MCE in the municipality increased in 31% the transfer of resources in relation to the other ones, keeping all other variables stable. This percentage is higher then in all other models. In relation to the municipal education director schooling levels, when they were post-graduated, there was a 13.9% increase in relation to the ones that have schooling levels bellow higher education. The variable statutory percentage in the municipality’s employee board did not have great impacts, despite having increased in relation to all other models, so that, in this one, for each 1% increase in the number of statutory employees in the municipality, there is a 0.3% increase in the group’s transfer of resources. Therefore, it is possible to affirm that municipalities with better educational offer conditions receive more resources when it depends on the initiatives by the municipal government.

Lastly, it is important to highlight that R2 values are relatively low, indicating that, in Models 1 and 2, respectively, only 21.6% and 20.3% of the variance of municipalities’ transfers are explained by the model’s variables. Therefore, one must consider that other variables that were not included in the model can better explain the transfers. It is important to also consider that most indicators used are proxies for the tested variables.

CONCLUDING REMARKS

The result of the regression analysis indicated that municipalities with better educational offer conditions have received more resources from the Union’s assistance during the analyzed period, however, there are indications that the induction mechanisms by the federal government have improved the municipalities’ situation in more unfavorable conditions.

The results from the Models 2 and 4 indicate that under a symmetrical treatment - be it through equal criteria for all or through a “dispute” - the programs’ resources tend to benefit municipalities with better educational conditions or with better technical-administrative capacities. These factors are expressed as characteristics of the school network that end up affecting the transfer of resources by the programs, according to its characteristics.

The results of Model 3 allow us to affirm that poorer municipalities (with lower percentage of own receipt) and with more unfavorable educational conditions are not the most benefited ones with resources from voluntary transfers by the Union for basic education, even with the adoption of induction mechanisms by the federal government to change such reality. However, it is important to observe that, in this model, the IDEB has presented a lower influence than in the other ones, indicating that the adoption of induction mechanisms is not enough to change this reality, but it lessens the effect of municipalities with higher IDEB in the transfer of resources.

The results in Model 1 explain how the first two groups of variables - the education offer conditions and the technical-administrative capacity - are complementary since they operate in different groups. Thus, when the transfer of resources by the Union’s technical and financial assistance programs are considered as a whole, there is a positive influence both of the federal government’s induction mechanism and the municipality’s technical-administrative capacity.

The results corroborate the arguments by Mendes (2013) on the influence of the stablished municipal structure on receiving resources, as well as the arguments by Abrucio (2010) on the influence of the municipal technical-administrative capacity on the scenario of territory inequality that distinguished the Brazilian federation.

On the other hand, the results also show that induction mechanisms by the federal government can override the technical-administrative capacity factors, as in the arguments by Arretche (2010, 2012, 2015a, 2015b), who affirms that policies matter and, moreover, their design matters for the reduction of inequalities. In the specific scope of the Union’s technical and financial assistance policies for the offer and maintenance of basic education, the results of the regression analysis point out the positive effect of the design of the analyzed programs for reducing resource inequality among Brazilian municipality, however, it still has limitations given the degree and diversity of inequality among municipalities.

Therefore, the results bring new elements for the aspect analyzed by Cruz (2009). One cannot properly affirm that there is a distortion in the criteria by the programs that aim to direct resources from MEC’s financial assistance mainly to places with lower education offer and quality indicators and the result of its transfers, since the induction factors of the federal government have influenced the transfer of resources to municipalities with unfavorable educational conditions. Besides, there was a great increase n the value/student received by the municipalities in the Northeast and Northern regions. However, the induction mechanisms do not yet present sufficient scope to change the inequality scenario, so that, even with an increase in a smaller scale, in comparison to municipalities in the Northeast and Northern regions, during the studied period, municipalities in other regions have kept on receiving more resources.

REFERENCES

ABRUCIO, F. A dinâmica federativa da educação brasileira: diagnóstico e propostas de aperfeiçoamento. In: OLIVEIRA, R P.; SANTANA, W. Educação e federalismo no Brasil: combater as desigualdades, garantir a diversidade. Brasília: UNESCO, 2010. p. 39-70. [ Links ]

ARAÚJO, R. L. S. Limites e possibilidades da redução das desigualdades territoriais por meio do financiamento da educação básica. 2013. 416 f. Tese (Doutorado em Educação) - Programa de Pós-graduação em Educação, Universidade de São Paulo, São Paulo,. [ Links ]

ARRETCHE, M. Federalismo e igualdade territorial: uma contradição em termos? DADOS - Revista de Ciências Sociais, Rio de Janeiro, v. 53, n. 3, p. 587-620, 2010. Acesso em:12 set. 2017. [ Links ]

ARRETCHE, M. Democracia, federalismo e centralização. Rio de Janeiro: Editora FGV; Editora Fiocruz, 2012. [ Links ]

ARRETCHE, M. Conclusões. In: ARRETCHE, M. (org.). Trajetórias das desigualdades: como o Brasil mudou nos últimos cinquenta anos. São Paulo: Editora Unesp; CEM, 2015a. p. 423-456. [ Links ]

ARRETCHE, M. Trazendo o conceito de cidadania de volta: a propósito das desigualdades territoriais. In: ARRETCHE, M. (org.). Trajetórias das desigualdades: como o Brasil mudou nos últimos cinquenta anos. São Paulo: Editora Unesp; CEM, 2015b. p. 193-222. [ Links ]

ARRETCHE, M.; RODDEN, J. Política distributiva na federação: estratégias eleitorais, barganhas legislativas e coalizões de governo. DADOS - Revista de Ciências Sociais, Rio de Janeiro, v. 47, n. 3, p. 549-576, 2004. [ Links ]

BUGARIN, M. S.; FERREIRA, I. F. Transferências Voluntárias e Ciclo Político-Orçamentário no Federalismo Fiscal Brasileiro. Revista Brasileira de Economia, Rio de Janeiro, v. 61, n. 3, p. 271-300, mar. 2007. ISSN 1806-9134. Disponível em:<Disponível em:http://bibliotecadigital.fgv.br/ojs/index.php/rbe/article/view/1087 >. Acesso em: 15 abr. 2017. [ Links ]

CAVALCANTI, Cacilda R. Tensões federativas no financiamento da educação básica: equidade, qualidade e coordenação federativa na assistência técnica e financeira da União. Tese (Doutorado em Educação) - Programa de Pós-graduação em Educação, Universidade Federal de Minas Gerais, Belo Horizonte, 2016. [ Links ]

CAVALCANTI, C. R.; OLIVEIRA, R. de F. Relações federativas no financiamento da educação básica: compreendendo o papel da União por meio dos atos normativos do FNDE. Educação On-Line(PUCRJ), v. 15, p. 36-56, 2014. [ Links ]

CRUZ, R. E. da. Pacto federativo e financiamento da educação: a função supletiva e redistributiva da União - o FNDE em destaque. 2009. 434 f. Tese (Doutorado em Educação) - Programa de Pós-graduação em Educação, Universidade de São Paulo, São Paulo. [ Links ]

DUCHATEAU, P. V.; AGUIRRE, B. M. B. Estrutura política como determinante dos gastos federais. In: XXXVEncontro Anual da ANPEC. Anais...São Paulo: ANPEC, 2007. [ Links ]

MENDES, C. C. Arranjos federativos e desigualdades regionais no Brasil. In: BOUERI R.; COSTA, M. A. Brasil em desenvolvimento 2013: estado, planejamento e políticas públicas. Brasília: Ipea, 2013. p.199-220. [ Links ]

MUSGRAVE, R. A. The theory of public finance: a study in public economy. New York: McGraw-Hill, 1959. [ Links ]

OBINGER, H.; LEIBFRIED, S.; CASTLES, F. G. (ed.). Federalism and the welfare state: New World and European Experiences. Local: Cambridge University Press, 2005. [ Links ]

REZENDE, F. Descentralização e transferências intergovernamentais de recursos na América Latina: Argentina, Brasil e Colômbia. Documentos e aportes administração pública gestão estatal, Santa Fé, n. 9, p. 55-102, 2007. Disponivel em: http://www.scielo.org.ar/scielo.php?script=sci_arttext&pid=S1851. [ Links ]

REZENDE, F. Federalismo fiscal: em busca de um novo modelo. In: OLIVEIRA, R. P. SANTANA, W. Educação e federalismo no Brasil: combater as desigualdades, garantir a diversidade. Brasília: UNESCO, 2010. [ Links ]

REZENDE, F. Reforma fiscal e equidade social. Rio de Janeiro: Editora FGV, 2012. [ Links ]

SANTOS, A. M. S. P. Desenvolvimento local e autonomia financeira dos municípios. Revista de Economia Mackenzie. São Paulo, v. 7, n. 2, p. 112-137, 2009. [ Links ]

SOARES, M. M. Repasses Financeiros e Voluntários da União aos Municípios Brasileiros: condicionantes políticos, sociais e técnicos. In: 8ºEncontro Anual da ABCP. Anais...Rio de Janeiro: ABCP, 2012. [ Links ]

WATTS, R. Comparing federal systems. Montreal: McGill-Queen’s University Press, 2008. [ Links ]

1In real value, updated by the Índice Nacional de Preço ao Consumidor Amplo (IPCA - Nationwide Consumer Price Index), in September 2015.

2The analysis of variance (ANOVA) is a method to test the equality of three or more population averages (null hypothesis) through the analysis of the sample variances. The results indicate if the interaction between the dependent variable and tested variables are significant.

3The INEP’s database does not show the IDEB for the initial elementary years for many municipalities, specially from 2004 to 2009.

4This is an arbitrary criterion by the authors, based on their knowledge of the physical school network and on their experience with the pedagogical work in many schools. .

5Data for this variable group were kindly conceded by the Professor Márcia Miranda Soares, of the Department of Political Sciences of UFMG, for the sole use in this research. .

6Note that the IDEB and the IPRFEM have scales in opposite directions. In the IDEB scale, the higher the coefficient, better the educational situation is; in the IPRFEM, the lower the coefficient, the worst the situation of the physical school network is. .

Received: April 15, 2018; Accepted: September 21, 2018

texto em

texto em